Mayank Kumar

Assistant Professor of Finance

Questrom School of Business, Boston University

My research interests lie in corporate finance and financial intermediation, with a focus on environmental finance and private equity. I study how financial frictions affect the energy transition and the role of financial markets in mitigating these frictions.

I hold a PhD in Finance from the Ross School of Business, University of Michigan.

📍 595 Commonwealth Avenue, Boston, MA 02215

Research

Revise & Resubmit, Journal of Finance

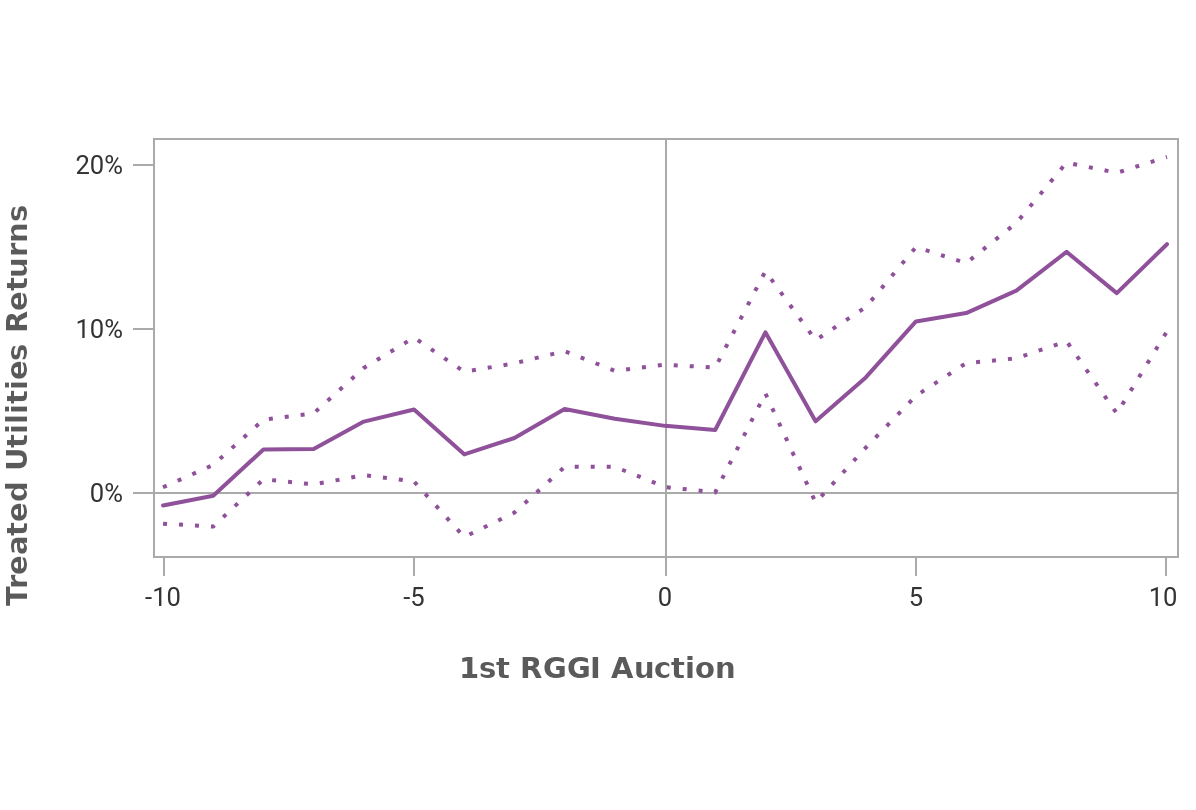

We establish a causal link between carbon emissions and shareholder value using the Regional Greenhouse Gas Initiative (RGGI), which imposed cap-and-trade regulation on electric utilities in Northeastern states. While the regulation successfully reduced CO₂ emissions and decreased short-term profitability, affected utilities experienced higher market-to-book ratios driven by increased expected future cash flows and demand from environmentally-focused institutional investors. Our results demonstrate that short-term profitability concerns may significantly impede carbon transition despite positive long-term value implications.

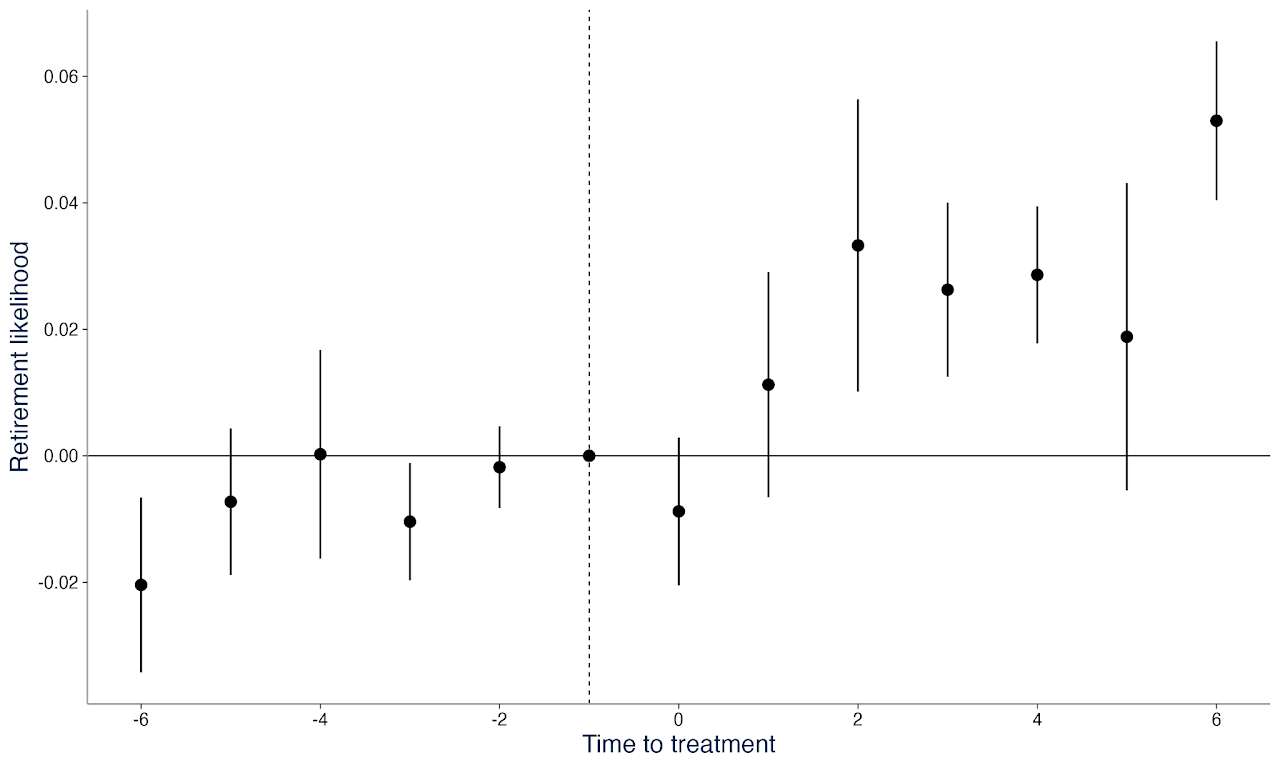

This paper demonstrates that private equity facilitates creative destruction in power generation by reallocating capital from inefficient to efficient assets. Exploiting the shale gas boom and staggered pipeline expansions as exogenous shocks, I find PE-owned coal and oil plants are significantly more likely to exit when they become uneconomic, while traditional utilities delay retirement due to political and social frictions. PE owners, less exposed to nonpecuniary pressures like labor opposition and reputational concerns, respond more efficiently to market signals. These findings suggest that well-intentioned social protections can inadvertently slow efficient exit and that PE ownership can enhance allocative efficiency.

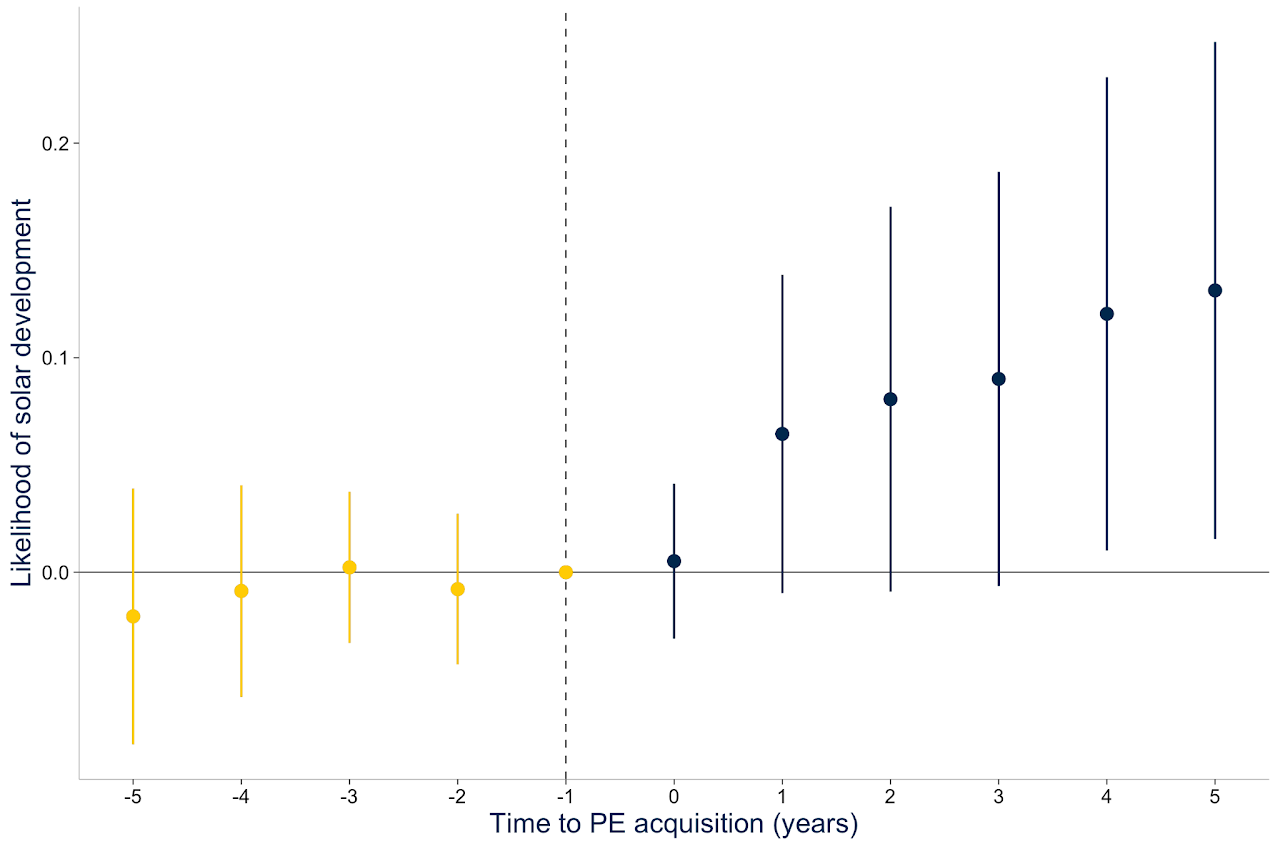

This paper shows that fossil fuel assets offer valuable opportunities for renewable development, and private equity firms are better positioned to identify and realize these opportunities. Using variation in solar investment potential and tax credit timing, I find PE firms are more likely to acquire fossil plants with greater solar development opportunities. PE acquisition leads to increased local solar development—a 3-percentage-point higher likelihood of new projects and 8% more solar capacity within five miles. These effects operate through operational improvements (battery storage investments) and PE relationships with institutional investors who finance solar projects. The findings suggest that regulations prohibiting PE investment in fossil fuels may unintentionally reduce clean energy investment.

🏆 Fixed Income Analyst Society Best Paper Award

🏆 E-Axes Forum Prize Honorable Mention

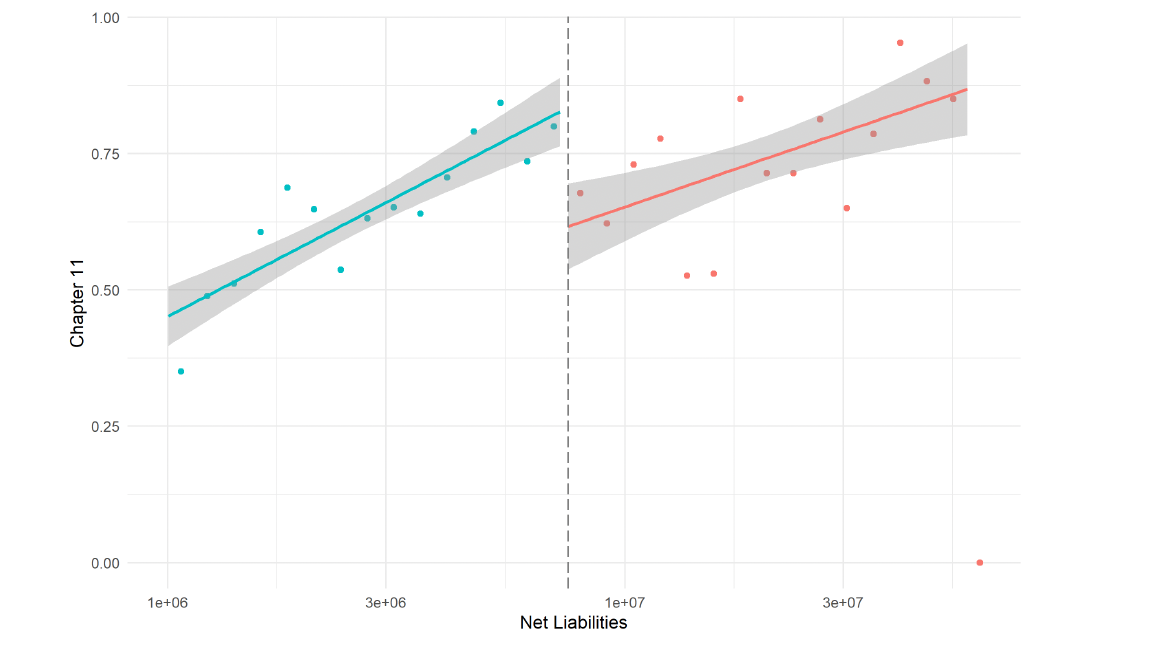

This paper studies how creditor rights affect small business bankruptcy outcomes. Exploiting the Small Business Reorganization Act of 2019 as an exogenous shock to creditor rights, I show that reducing creditor power increases Chapter 11 filings, but successful reorganization only increases for firms with secured debt and multiple creditors. The findings suggest that secured creditors exhibit liquidation bias and excess market power, while multiple-creditor contexts create coordination failures that impede contract renegotiation outside of bankruptcy.

Teaching

SM 132: Measuring Financial Value (BBA Core)

Boston University, 2025-Present

Overview of fundamental financial analyses including time value of money, interest rates, and basic valuation.

FIN 317: Corporate Financing Decisions (BBA)

University of Michigan, 2023 | Student Evaluation: 4.9/5

Advanced corporate financial management covering capital structure, payout policy, M&A, and risk management.